New Business Online and Mobile Banking

The way you experience business banking is changing. Get ready for the new and improved Business Online and Business Mobile, launching on Monday, July 22.

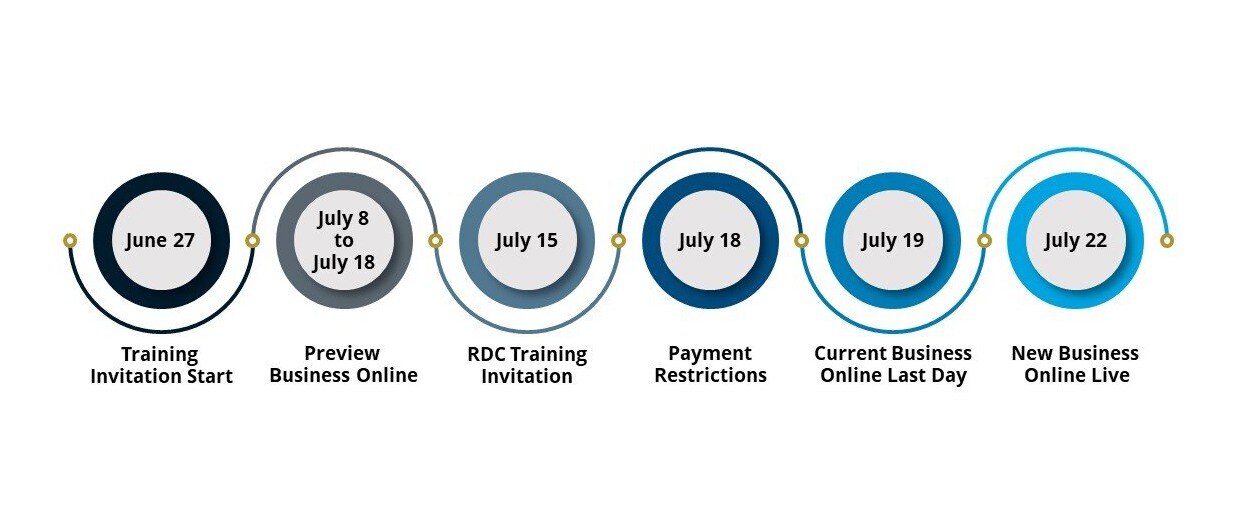

Key dates leading up to your transition:

Monday, July 15

RDC Training Invitation

Look for the training invitation email we sent to you from clientsupport@support.bancofcal.com. Or call us at 855-265-9785.

New Business Online

is live

- All Business Online users can login at bancofcal.com to the new Business Online now.

- Attend a Remote Deposit Capture training session to install the latest scanner software. Appointments are available until August 7.

View a demo:

Ready to see the new Business Online click-through Demo for yourself? View the demo. This self-guided tour allows you to navigate a sample version of your new online service at your own pace.

Guides and Video Training

Need a closer look after your click-through demo? Please refer to these guides and training videos:

.png)

New Business Online Training

Watch the webinar featuring a general platform overview plus ACH / Wire training.

Frequently asked questions

When do I need to start using my new Business Online service?

To help you become familiar with the new system, we recommend you preview your new Banc of California Business Online service between July 8 and July 18. This will ensure that your company and all users are fully prepared to start using the upgraded service on July 22. An email was sent to you on July 8 with login instructions for the start of the preview period, but here is an overview:

- Go to bancofcal.com, select Online Banking at the upper right, and then select the new “preview” Business Online Login.

- Enter your updated Business Online credentials:

- Company ID: The bank emailed this 7-digit number to each user at your company on July 8.

- User ID: Same as the current User ID. Must be four characters or more.*

*If your current user ID is under four characters, add the character “1” at the end to make the user ID four characters. For example, a user ID of “Jo” becomes “Jo11.” If your user ID on the old system contained special characters, please omit them when logging in to new Business Online. - Passcode: You will be prompted to receive a one-time passcode by phone call or text at the phone number on record for your User ID.

- Password: The bank emailed this information to each user at your company by July 8.

- Soft Token: If your company has wire or ACH payments, you will be prompted to download and set up the SecureID RSA Authenticator soft token on your mobile device.

What else should I do during the preview period between July 8 and July 18?

The preview period is your opportunity to learn about your new Business Online service so that you are ready to use it on July 22.

Please ensure that:

- All company users log in between July 8 at 8 a.m. PT and July 18 at 3 p.m. PT.

- Administrator and non-administrator access are properly established for all services and payments that your company requires.

- Administrators review the wire and ACH limits for all non-administrators and make any needed changes.

- All wire and ACH templates are converted and payees are available, and use this time to make any needed adjustments.

- You agree to new security procedures when you first log in to the new Business Online service.

- You do not make any administrative changes in your old system after 5 p.m. PT on June 14 because they will not be converted. You will need to repeat these administrative changes in your new system.

- You take advantage of the training opportunities we will be offering to help:

- Establish your new business online login by Thursday, July 18, at 3 p.m. PT to avoid expected longer than usual waiting times for phone support on July 22 and the following days.

- Set up your mobile token app if you send wires and ACH.

- Familiarize yourself with how to navigate wires, ACH and user administration.

- Prepare to move file transmissions to the new system.

- Prepare for the RDC transition or training.

What do I need to do starting July 22?

Please review and verify that you have taken the steps suggested for the preview period and then follow the recommended actions below to help ensure a smooth transition.

Alerts and Report Delivery

Schedule all needed transactions. No future-dated or recurring transfers, wires, or ACH will convert to the new system.

Bill Pay and eBills

- Payments you set on your old bill pay service with a “deliver by” date of July 25 will continue to process, but they will not be visible on your new bill pay system until July 25. You can easily check on a payment by calling us.

- Your payees will convert to the new system and there is no action required.

- Recurring and future-dated payments with a “deliver by” date on or after July 26 will convert to the new system. Please verify that they are properly established.

- Initially, please allow up to five (5) days for your payments to be delivered on your new bill pay system.

- eBills and their payment settings will not convert to the new system. Please be sure to set up any needed eBills and payment settings to ensure your payments are made on time. Note: It may take up to one month for your eBiller to transition to your eBill. You may need to make alternative payment arrangements in the interim.

Financial Management Software: Be sure to reset all your data downloads to your Quicken, QuickBooks, QuickBooks.com, and similar online and accounting services.

Payment Files: Set up and map any custom payment files to the new system. File layouts will not transfer to the new system.

Positive Pay: Ensure your check issuance file uploads to the new location.

Remote Deposit Capture: Download and install a new driver for your check scanner. We will send you information and offer a dedicated training session on or after July 22.

Transfers, Wires, ACH: Schedule all needed transactions. Future-dated or recurring transfers, wires and ACH will not convert to the new system.

Will I have access to online statements and check images?

Business client online statement settings will remain unchanged. It will take a few weeks for your online statements and check images to be available online after July 22. Please download any statements or check images from your old online banking system that you will need in the interim by July 19 at 5 p.m. PT. You may contact us if you need access to these during the interim period.

Will my account transaction data be converted?

Yes, 90 days of account transaction data will be available on July 22. By the end of the following week, you will have access to two years of transaction history.

Will the details of my wire, ACH and transfer history data be converted?

Your statement account history data will be converted. Your detailed payment transaction data, which includes information such as which user authorized the transaction and other payee details, will not be converted to your new online banking system. You can download this data from within your old online banking service before July 19 at 5 p.m. PT. Please contact us if you need assistance.

Does new Business Online banking offer security passcodes and tokens?

Yes. Clients will be converted to new security procedures that include login with a passcode and approval of wires and ACH with a token; some clients will also be required to use a token at login. Please be sure you have a current phone number on record to receive your passcode via text or voice call. Clients who require a token at login will continue to have a token at login.

Are security procedures changing with my new Business Online service?

IMPORTANT: The security procedures applicable to existing Banc of California clients will be changing upon conversion. A token or other security measure is no longer required to approve administrative changes or the entry of wire or ACH payments. You will be asked to agree to the new security procedures when you first log in to the new Business Online service. A token or other security measure continues to be required to approve wire and ACH payments. We are happy to discuss security options with you or answer any questions.

For Business Online, will my old token and secure browser work?

No, you may delete them. You will be prompted to set up a new mobile token app. The secure browser is no longer offered.

How do I set up my new Business Online token?

If you need a token, Business Online will prompt you to set up a new mobile token app. You will be prompted to visit the Apple App Store or Google Play on your mobile device, search for, and install the RSA SecurID Authenticator token app. Then, follow the easy prompts in both the app and Business Online to complete the setup process. For further assistance, additional documentation is available online.

Will all my accounts be available?

You will have access to all the deposit and loan accounts as before except for SBA loans, which will no longer be available online. Loan and CD balances will not be available until July 23.

Stay informed: enhancing your transition experience

We're committed to making this transition as seamless as possible for you, so we ask that you please stay tuned for more information on the following:- Training opportunities

- Access to login information and recommended next steps

Have questions? We're here to help.

Please reach out to your dedicated relationship manager or call us at 855-351-BANC (2262).